Established in 2019, Lion Partners Capital is a private equity investment company backed by some financial groups in Southeast Asia. Pooling fund resources from industrial leading enterprises, we are devoted to investing in the enterprises specialized in the development and application of new-generation information technology, consumer technology, and green technology, based on the investment logic of demand-based iteration, technological upgrading, sustainable development, and the potential of going global.

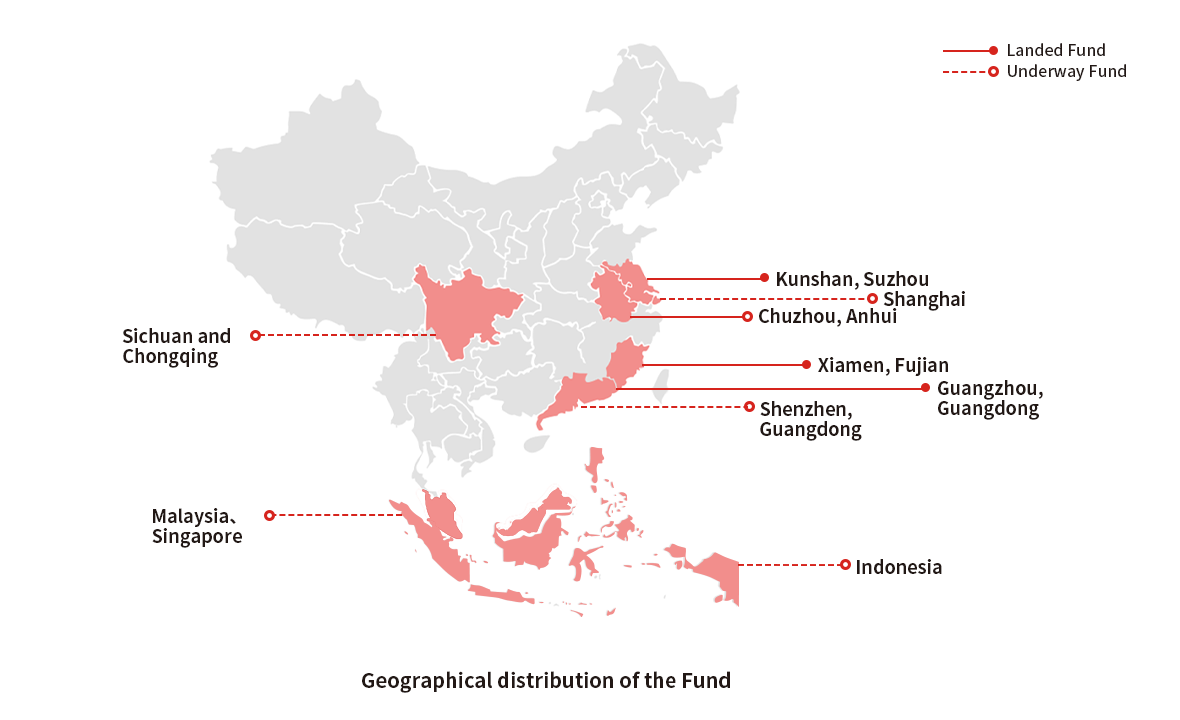

Currently, we are managing four comprehensive funds located in Xiamen, Guangzhou, Suzhou, and Anhui respectively.

Our team has rich experience in professional investment and the methodology of systematic investment and post-investment management. We have led the investment in a number of companies already publicly listed at home and abroad, such as Yusys Technologies, Brandmax, Xindu Chemical, Gojek, and Nanofilm.

Company Overview ABOUT US